In an ever more interconnected global financial system, organizations functioning in the Middle East and Africa (MEA) encounter a various spectrum of credit threats—from risky commodity charges to evolving regulatory landscapes. For monetary institutions and corporate treasuries alike, sturdy credit rating danger management is not only an operational necessity; It is just a strategic differentiator. By harnessing exact, well timed data, your worldwide possibility administration staff can transform uncertainty into chance, making certain the resilient progress of the businesses you help.

1. Navigate Regional Complexities with Self esteem

The MEA area is characterized by its financial heterogeneity: oil-pushed Gulf economies, source-prosperous frontier markets, and quickly urbanizing hubs throughout North and Sub-Saharan Africa. Every industry provides its have credit history profile, authorized framework, and forex dynamics. Info-pushed credit rating chance platforms consolidate and normalize data—from sovereign ratings and macroeconomic indicators to unique borrower financials—enabling you to:

Benchmark danger throughout jurisdictions with standardized scoring designs

Identify early warning indicators by monitoring shifts in commodity charges, Forex volatility, or political chance indices

Improve transparency in cross-border lending selections

two. Make Informed Selections by means of Predictive Analytics

Instead of reacting to adverse gatherings, top institutions are leveraging predictive analytics to foresee borrower stress. By applying device Discovering algorithms to historical and actual-time details, it is possible to:

Forecast chance of default (PD) for company and sovereign borrowers

Estimate publicity at default (EAD) under various economic situations

Simulate reduction-specified-default (LGD) utilizing recovery costs from earlier defaults in identical sectors

These insights empower your team to proactively adjust credit limits, pricing techniques, and collateral demands—driving superior possibility-reward results.

3. Improve Portfolio Overall performance and Capital Performance

Precise knowledge allows for granular segmentation of your credit history portfolio by marketplace, region, and borrower size. This segmentation supports:

Hazard-modified pricing: Tailor interest fees and charges to the specific possibility profile of every counterparty

Focus monitoring: Limit overexposure to any one sector (e.g., Strength, construction) or state

Money allocation: Deploy financial capital additional effectively, lessening the price of regulatory funds under Basel III/IV frameworks

By constantly rebalancing your portfolio with facts-pushed insights, it is possible to improve return on hazard-weighted assets (RORWA) and unencumber cash for expansion prospects.

four. Strengthen Compliance and Regulatory Reporting

Regulators throughout the MEA region are ever more aligned with global specifications—demanding demanding strain tests, circumstance Assessment, and clear reporting. A centralized details System:

Automates regulatory workflows, from details selection to report era

Makes certain auditability, with whole details lineage and alter-management controls

Facilitates peer benchmarking, comparing your establishment’s metrics from regional averages

This lessens the chance of non-compliance penalties and enhances your track record with each regulators and buyers.

5. Boost Collaboration Throughout Your World wide Possibility Crew

Having a unified, data-pushed credit rating chance management method, stakeholders—from entrance-Place of work partnership administrators to credit score committees and senior executives—attain:

True-time visibility into evolving credit exposures

Collaborative dashboards that spotlight portfolio concentrations and worry-take a look at final results

Workflow integration with other hazard functions (current market danger, liquidity possibility) for a holistic business possibility view

This shared “single source of fact” gets rid of silos, accelerates decision-producing, and fosters accountability at each individual amount.

six. Mitigate Rising and ESG-Similar Dangers

Past regular economical metrics, modern credit risk frameworks incorporate environmental, social, and governance (ESG) factors—important inside a region where sustainability initiatives are attaining momentum. Facts-driven resources can:

Rating borrowers on carbon intensity and social effect

Model changeover hazards for industries exposed to shifting regulatory or purchaser pressures

Guidance eco-friendly funding by quantifying eligibility for sustainability-connected financial loans

By embedding ESG facts into credit score assessments, you don't just long run-proof your portfolio but will also align with world-wide Trader anticipations.

Conclusion

From the dynamic landscapes of the Middle East and Africa, mastering credit rating risk management requires over instinct—it demands demanding, data-driven methodologies. By leveraging correct, in depth info and Highly developed analytics, your world-wide hazard administration group may make well-informed choices, optimize money Credit Risk Management utilization, and navigate regional complexities with self esteem. Embrace this approach these days, and rework credit rating hazard from the hurdle right into a competitive benefit.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Mason Reese Then & Now!

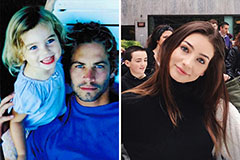

Mason Reese Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!